Gauge the impact of shifting M&A volumes in Mining

Deal-making sentiment seems to have emerged stronger out of the downturn as M&A activity reached a record high during 2021. The momentum set in towards the end of 2020, continued through 2021 with all the quarters reporting deals with a cumulative value of around $1 trillion across the year. While most deals-based analyses focus on the win or lose for deal participants, GlobalData's League Tables provide you with insights on the oil and gas players benefitting from these M&A volumes. The deal types covered in our report include: Use our report to understand your company’s performance across target regions and get insight into the volumes your competitors are able to generate in your markets of focus. by GlobalDataEnter your details here to receive your free Report. Validation is RequiredBy clicking the Downloadbutton, you accept the terms and conditions and acknowledge that your data will be used as described in the GlobalData privacy policyBy downloading this Report, you acknowledge that we may share your information with our white paper partners/sponsors who may contact you directly with information on their products and services.Visit our privacy policy for more information about our services, how we may use, process and share your personal data, including information on your rights in respect of your personal data and how you can unsubscribe from future marketing communications.Our services are intended for corporate subscribers and you warrant that the email address submitted is your corporate email address.

This marks an acceleration in growth from the 78.6% increase in deals seen from the first six months of 2020 to the same period in 2021.

During this time, the region that saw the biggest increase in the number of deals was the Asia-Pacific region, with deals rising by 200% in the region.

Related

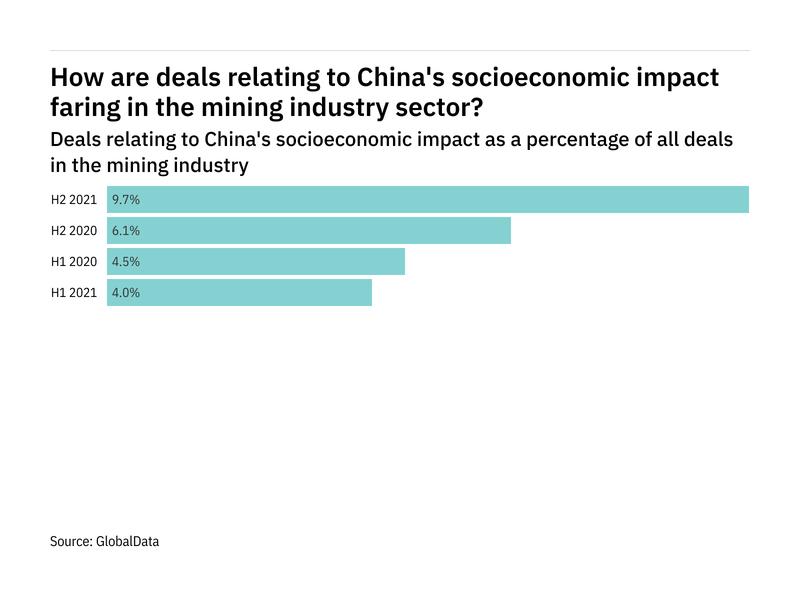

AnalysisDeals relating to China's socioeconomic impact increased significantly in the mining industry in H2 2021

AnalysisIoT deals decreased significantly in the mining industry in H2 2021

AnalysisAcquisitions increased significantly in the mining industry in H2 2021

From the second half of 2020 to the second half of 2021, the largest regional increase in deals was also seen in the Asia-Pacific region, with a 900% increase.

During second half of 2021, acquisitions accounted for 31.1% of deals taking place in the sector. This represents an increase from the figure of 14.7% in the second half of 2020.

GlobalData's deals database is a comprehensive repository that looks at mergers, acquisitions, venture financing, equity offerings, asset transactions, partnerships, and debt offerings taking place daily between thousands of companies across the world.

The database details key deal information, such as deal summary, deal rationale, deal financials, parties involved, advisors, and deal payment modes.

Data, insights and analysis delivered to you View all newslettersBy the Mining Technology team Sign up to our newslettersBy tracking the proportion of various types of deals in each sector, we can gauge which sectors are seeing growth and where others are struggling.

The highest value acquisition that took place in 2021 (where the deal value was known) was the $2.8bn acquisition of Pretium Resources by Newcrest Mining.

The database states that the rationale behind this deal was as follows: "The transaction will enable Pretium Resources to expand expanding our presence in this highly prospective region in British Columbia."

Related Companies

Organiseit

Digital Office Database Filing Solutions

Visit ProfileVEGA Americas

Level, Density, and Pressure Measurement within the Mining Sector

Visit ProfileSIFCO ASC

Selective Electroplating and Anodising Solutions for the Mining Industry

Visit ProfileGauge the impact of shifting M&A volumes in Mining

Deal-making sentiment seems to have emerged stronger out of the downturn as M&A activity reached a record high during 2021. The momentum set in towards the end of 2020, continued through 2021 with all the quarters reporting deals with a cumulative value of around $1 trillion across the year. While most deals-based analyses focus on the win or lose for deal participants, GlobalData's League Tables provide you with insights on the oil and gas players benefitting from these M&A volumes. The deal types covered in our report include: Use our report to understand your company’s performance across target regions and get insight into the volumes your competitors are able to generate in your markets of focus. by GlobalDataEnter your details here to receive your free Report. Validation is RequiredBy clicking the Downloadbutton, you accept the terms and conditions and acknowledge that your data will be used as described in the GlobalData privacy policyBy downloading this Report, you acknowledge that we may share your information with our white paper partners/sponsors who may contact you directly with information on their products and services.Visit our privacy policy for more information about our services, how we may use, process and share your personal data, including information on your rights in respect of your personal data and how you can unsubscribe from future marketing communications.Our services are intended for corporate subscribers and you warrant that the email address submitted is your corporate email address.

Thank you.Please check your email to download the Report.