How is Toyota ensuring its future success?

Toyota is accelerating digital growth and serving their clients better. The company is investing in emerging technologies to maintain its segment operations, drive site traffic and revive its business prospects amid COVID-19. Toyota AI Ventures along with Toyota Research Institute (TRI) launched the Call for Innovation initiative to promote innovation around robotics technology. It made a significant amount of investment in startups working on mobile technologies for assistive robots. Our Enterprise Tech Ecosystem report on Toyota provides you with information and insights into their digital transformation strategies, including: Download the full report to align your strategies for success and get ahead of the competition. by GlobalDataEnter your details here to receive your free Report. Validation is RequiredBy clicking the Downloadbutton, you accept the terms and conditions and acknowledge that your data will be used as described in the GlobalData privacy policyBy downloading this Report, you acknowledge that we may share your information with our white paper partners/sponsors who may contact you directly with information on their products and services.Visit our privacy policy for more information about our services, how we may use, process and share your personal data, including information on your rights in respect of your personal data and how you can unsubscribe from future marketing communications.Our services are intended for corporate subscribers and you warrant that the email address submitted is your corporate email address.

The assessment comes from GlobalData’s Thematic Research ecosystem, which ranks companies on a scale of one to five based on their likelihood to tackle challenges like Internet of Things and emerge as long-term winners of the automotive sector.

According to our analysis, Tesla, Amazon, Sierra Wireless, Didi Chuxing, STMicroelectronics, Infineon, Grab, Samsung Electronics, Qualcomm, Gett, Gojek and Uber are the companies best positioned to benefit from investments in Internet of Things, all of them recording scores of five out of five in GlobalData’s Future Mobility and Vehicle Manufacturing Thematic Scorecards.

Amazon indicated good levels of AI investment, with the company looking for 3,969 new Internet of Things jobs since January 2021; and mentioning Internet of Things in filings 23 times.

Related

AnalysisRESEARCH SNAPSHOT - Mirrorless cars

AnalysisFebruary 2016 management briefing: Geneva preview

AnalysisPresident outlines new Honda world order

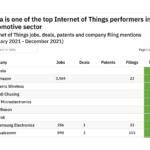

The table below shows how GlobalData analysts scored the biggest companies in the automotive industry on their Internet of Things performance, as well as the number of new Internet of Things jobs, deals, patents and mentions in company reports since January 2021.

The final column in the table represents the overall score given to that company when it comes to their current Internet of Things position relative to their peers. A score of five indicates that a company is a dominant player in this space, while companies that score less than three are vulnerable to being left behind. These can be read fairly straightforwardly.

The other datapoints in the table are more nuanced, showcasing recent Internet of Things investment across a range of areas over the past year. These metrics give an indication of whether Internet of Things is at the top of executives’ minds now, but high numbers in these fields are just as likely to represent desperate attempts to catch-up as they are genuine strength in Internet of Things.

For example, a high number of mentions of Internet of Things in quarterly company filings could indicate either the company is reaping the rewards of previous investments, or it needs to invest more to catch up with the rest of the industry. Similarly, a high number of deals could indicate that a company is dominating the market, or that it is using mergers and acquisitions to fill in gaps in its offering.

Data, insights and analysis delivered to you View all newslettersBy the Just Auto team Sign up to our newslettersThis article is based on GlobalData research figures as of 13 January 2022. For more up-to-date figures, check the GlobalData website.

How is Toyota ensuring its future success?

Toyota is accelerating digital growth and serving their clients better. The company is investing in emerging technologies to maintain its segment operations, drive site traffic and revive its business prospects amid COVID-19. Toyota AI Ventures along with Toyota Research Institute (TRI) launched the Call for Innovation initiative to promote innovation around robotics technology. It made a significant amount of investment in startups working on mobile technologies for assistive robots. Our Enterprise Tech Ecosystem report on Toyota provides you with information and insights into their digital transformation strategies, including: Download the full report to align your strategies for success and get ahead of the competition. by GlobalDataEnter your details here to receive your free Report. Validation is RequiredBy clicking the Downloadbutton, you accept the terms and conditions and acknowledge that your data will be used as described in the GlobalData privacy policyBy downloading this Report, you acknowledge that we may share your information with our white paper partners/sponsors who may contact you directly with information on their products and services.Visit our privacy policy for more information about our services, how we may use, process and share your personal data, including information on your rights in respect of your personal data and how you can unsubscribe from future marketing communications.Our services are intended for corporate subscribers and you warrant that the email address submitted is your corporate email address.

Thank you.Please check your email to download the Report.Topics in this article: Amazon, scorecards, Tesla