DUBLIN--(BUSINESS WIRE)--The "United States Motor Insurance Market - Growth, Trends, COVID-19 Impact, and Forecasts (2022 - 2027)" report has been added toResearchAndMarkets.com's offering.

The United States Motor Insurance Market is estimated to grow at a CAGR of approximately 3% during the forecast period.

The United States insurance industry's net premiums in 2018 amounted to USD 1.22 trillion, with premiums paid by non-life insurers accounting for 51%, and premiums for life insurers accounting for 49%.

The overall net premium written for non-life was USD 618 Billion in 2018. The auto sector is facing significant change as the autonomous vehicle (AV) revolution likely brings a fundamental shift from personal ownership to shared mobility.

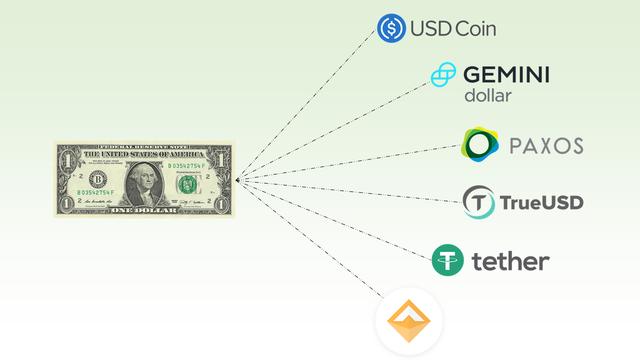

This dramatic reshaping of the auto industry is bound to have far-reaching effects on other sectors as well including insurance, urban planning and infrastructure, and supply chain management. In order to manage the low-growth, low-profit, non-life insurers have focused on innovation and disruption, demonstrating a strong interest in new technological developments, including telematics, the Internet of Things (IoT) and blockchain.

Key Market Trends

Increase in Motor vehicles registration:

At about 17.2 million new light-vehicle registrations in 2018, the United States is one of the biggest car markets in the world based on the number of new light-vehicle registrations. Nevertheless, fewer than three million vehicles were manufactured in the United States of the 70.5 million passenger cars manufactured worldwide in 2016.

While the United States imports large quantities of vehicles from different countries, such as Japan, Mexico, and Canada, passenger car assembly in the country increased from about 2.2 million units produced in 2009 to just under 4 million units in 2016.

Toyota and BMW are the leading carmakers selling imported cars in the United States. This trend is expected to continue as there is an increase in demand for lightweight vehicles.

Fintech adoption in developed economies:

Fintech is transforming the US financial sector is stating the obvious. It is rapidly transforming how people lend, invest, opt for loans, fund start-ups and even buy insurance. American companies have attracted the biggest fintech investments from 2010 - 2016, which indicates a clear need for fintech services in the United States.

In 2017, insurance became the second-most popular fintech service. InsurTech companies are leveraging design, technology, and flexible services to make health insurance more appealing to consumers - something that would be beyond the purview of the traditional insurers.

For more information about this report visit https://www.researchandmarkets.com/r/yza4a7

src="https://cts.businesswire.com/ct/CT?id=bwnewssty=20220311005381r1sid=acqr8distro=nxlang=en" style="width:0;height:0" />

View source version on businesswire.com: https://www.businesswire.com/news/home/20220311005381/en/

ResearchAndMarkets.comLaura Wood, Senior Press Manager[email protected]

For E.S.T Office Hours Call 1-917-300-0470For U.S./CAN Toll Free Call 1-800-526-8630For GMT Office Hours Call +353-1-416-8900

Source: Research and Markets