House prices in UK cities now average eight times local annual earnings, as price growth continues to outstrip wage rises.

New research by Halifax found that houses cost anything from five times your yearly salary to 14 times, depending on which city you live in.

Here, Which? reveals the most and least affordable cities to buy a home, and offers advice on how to find the best place to live.

Properties in cities cost eight times average earnings

You might have read all about homeowners escaping to the country since the start of the Covid-19 pandemic, but cities certainly haven’t been left behind when it comes to house prices.

Halifax found that prices in UK cities have grown by 10.3% in the last year, while average earnings rose by just 2.1%.

This has resulted in properties becoming less affordable. The average house price in a UK city is now 8.1 times the average annual earnings of someone living there.

This figure has now risen for eight consecutive years, having stood at 5.6 in 2013.

The most affordable cities to buy a home

If you’re thinking of buying a property, you might find these figures intimidating, but affordability varies dramatically depending on where you’re buying.

The 10 most affordable cities to buy a home in the UK all come in at less than six times average annual earnings.

Table-topping Derry/Londonderry, Carlisle and Bradford are the only three cities where house prices are below five times earnings.

Hereford in the West Midlands was the most southerly city in the top 20, with prices at 6.6 times earnings, reflecting a north/south divide in property prices.

The 10 most affordable cities to buy a home

| City | Region | Average house price | Average annual earnings | House price to annual earnings |

| Derry | Northern Ireland | £155,917 | £33,138 | 4.7 |

| Carlisle | North | £163,232 | £34,087 | 4.8 |

| Bradford | Yorkshire | £164,410 | £34,219 | 4.8 |

| Stirling | Scotland | £208,927 | £38,744 | 5.4 |

| Aberdeen | Scotland | £205,199 | £38,016 | 5.4 |

| Glasgow | Scotland | £196,625 | £36,205 | 5.4 |

| Perth | Scotland | £203,229 | £36,700 | 5.5 |

| Inverness | Scotland | £191,840 | £34,373 | 5.6 |

| Hull | Yorkshire | £156,424 | £27,230 | 5.6 |

| Dundee | Scotland | £181,150 | £31,344 | 5.8 |

Source: Halifax

Most unaffordable cities to buy a home

At the other end of the table, Winchester has replaced Oxford as the UK’s least affordable city.

Homes in the Hampshire city cost a massive 14 times the annual earnings of people living and working there.

All of the top 10 most unaffordable cities have prices of at least 10 times average earnings, and the vast majority are located in the south of England.

The 10 least affordable cities to buy a home

| City | Region | Average house price | Average annual earnings | House price to annual earnings |

| Winchester | South East | £630,432 | £45,059 | 14 |

| Oxford | South East | £486,928 | £39,220 | 12.4 |

| Truro | South West | £356,788 | £29,558 | 12.1 |

| Bath | South West | £476,470 | £39,508 | 12.1 |

| Chichester | South East | £446,899 | £37,352 | 12 |

| Cambridge | East Anglia | £482,300 | £40,492 | 11.9 |

| Brighton & Hove | South East | £449,243 | £38,737 | 11.6 |

| Greater London | Greater London | £594,695 | £51,257 | 11 |

| St Albans | South East | £604,423 | £59,391 | 10.2 |

| Chelmsford | South East | £424,690 | £41,781 | 10.2 |

Source: Halifax

Where have house prices increased the most?

Winchester has the highest average house price of any UK city (£630,432), while Hull has the lowest (£156,924). That means you could buy four homes in Hull for less than the price of one in Winchester.

Halifax says that the average cost of buying a home in a UK city has increased by 10% in the past year. Salisbury has seen the biggest rise (a massive 36%), followed by Hereford (29%), Lancaster, and Birmingham (both 19%).

Halifax found that Gloucester is the city with the highest growth over the past decade. Prices in Gloucester have increased by 101% since 2011, well outstripping the UK average of 71%.

How do cities compare with the rest of the UK?

We’ve focused on the cost of buying in a city, but house prices elsewhere in the UK provide important context to how cities are performing compared to towns and rural areas.

Halifax’s data shows the average house price to earnings ratio in the UK as a whole is 8.5, slightly above the 8.1 recorded for cities.

While this gap might seem small, it’s the biggest recorded since 2014. This perhaps reflects rising house prices in more rural areas due to the recent stamp duty cut.

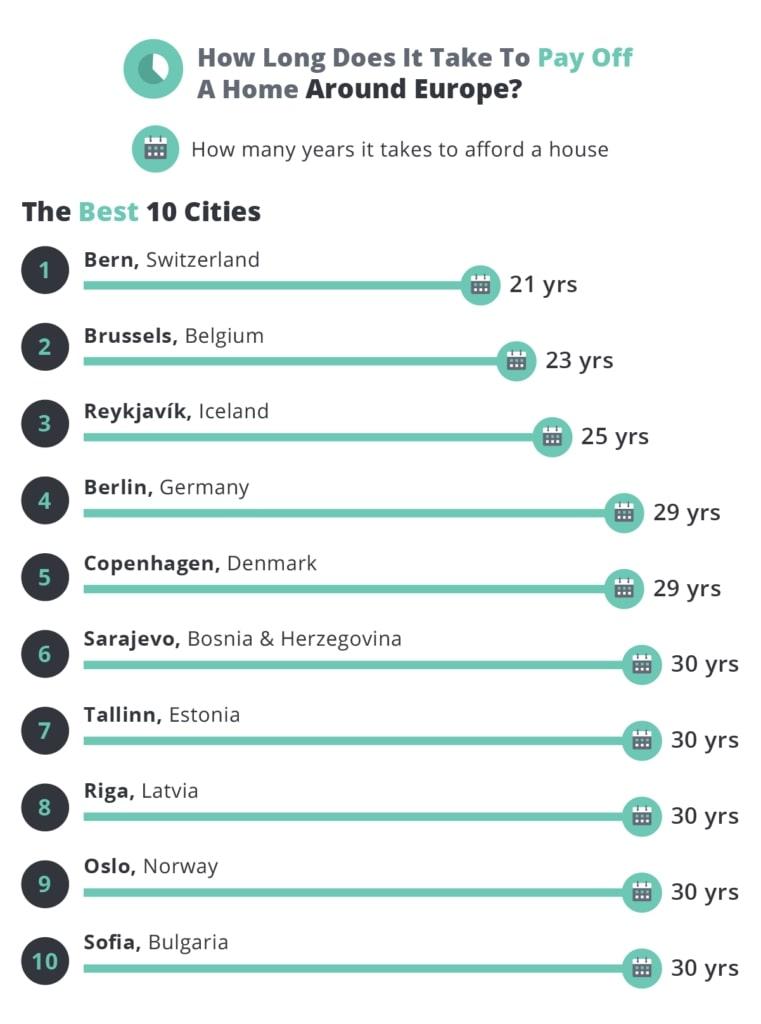

The chart below shows how house prices have become less affordable over the past decade, with price rises significantly outstripping wage growth.

How to find the best place to live

Finding the right place to live isn’t just about the price, but rather a whole range of work, leisure, and lifestyle factors.

It’s important to thoroughly research an area before taking the leap. If you like eating out, are there good restaurants nearby? If you prefer exercising regularly, are the gyms any good?

Depending on your priorities, you might want to consider things like transport connections, pollution levels, services such as banks and GP surgeries, and of course local schools.

Our guide on finding the best place to live contains lots of great tips on how to settle on the best area to buy a home.