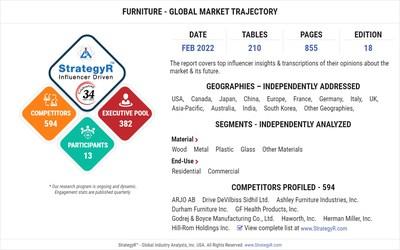

New York, March11, 2022(GLOBE NEWSWIRE) -- Reportlinker.com announces the release of the report "Global Furniture Industry" - https://www.reportlinker.com/p05817853/?utm_source=GNW-Online interactive peer-to-peer collaborative bespoke updates-Access to our digital archives and MarketGlass Research Platform-Complimentary updates for one year Global Furniture Market to Reach $616.7 Billion by 2026With the COVID-19-induced shelter-in-place mandates keeping people within their homes, there is significant increase in demand for home goods including furniture through online platforms. Though many furniture retailers closed their stores, some received increased online orders. While stores remained closed, some retailers started offering curb-side pick-up or delivery to customers. Some others introduced online showrooms. For example, the virtual showroom introduced by BoConcept allows customers to view the items in the way they are styled in store, examine them closely, and even ask questions about the products. Online retailers such as Overstock.com and Wayfair are witnessing considerable increase in sales. While the early days of the pandemic witnessed huge increase in demand for home-office furniture, over the past few months, there is growing demand for outdoor furniture as well as indoor recreational products such as pool floats as people start planning to spend their summer holidays at home.In the US, before COVID-19 outbreak, less than 15% of furniture sold in the US was through online stores. With a significant proportion of furniture supply closing down due to COVID-19, the online stores market has boomed, although the gains could be a temporary phenomenon until the stores reopen. For instance, Wayfair, an online furniture company, recorded a boom in business as consumers decorate or furnish home offices while being shut indoors due to the coronavirus pandemic. Almost the entire nation has shifted to remote learning or working from home as schools and offices remain shut to help contain the spread of the coronavirus pandemic. Few consumers have sought standing desks or more comfortable chairs on online stores to spruce up home offices. The closure of almost all physical stores for the time being has greatly benefited the online furniture store Wayfair in meeting consumer demand. Consumers confined to their homes are also utilizing the free time available with them on decorating their homes. The e-commerce model of Wayfair is well suited to serve the practical needs of customers in the current challenging scenario.Amid the COVID-19 crisis, the global market for Furniture estimated at US$464 Billion in the year 2020, is projected to reach a revised size of US$616.7 Billion by 2026, growing at a CAGR of 4.9% over the analysis period. Wood, one of the segments analyzed in the report, is projected to grow at a 5.7% CAGR to reach US$233.8 Billion by the end of the analysis period. After a thorough analysis of the business implications of the pandemic and its induced economic crisis, growth in the Metal segment is readjusted to a revised 5% CAGR for the next 7-year period. This segment currently accounts for a 20.9% share of the global Furniture market. The U.S. Market is Estimated at $105.2 Billion in 2021, While China is Forecast to Reach $101.7 Billion by 2026The Furniture market in the U.S. is estimated at US$105.2 Billion in the year 2021. The country currently accounts for a 22.07% share in the global market. China, the world second largest economy, is forecast to reach an estimated market size of US$101.7 Billion in the year 2026 trailing a CAGR of 6.3% through the analysis period. Among the other noteworthy geographic markets are Japan and Canada, each forecast to grow at 3.1% and 4.2% respectively over the analysis period. Within Europe, Germany is forecast to grow at approximately 3.7% CAGR while Rest of European market (as defined in the study) will reach US$108.3 Billion by the close of the analysis period.The market will continue to be driven by the rapid pace of urbanization and growing real estate industry especially in developing countries. Growing investments in infrastructure and commercial development projects will further provide growth opportunities in the furniture market. The increasing number of modification and renovation projects in countries such as India, United States and China is another major market driver. Positive trade relations among several countries and policies by the governments such as relaxations in FDI have resulted in increasing number of multinational companies and technology parks. The surge in construction of offices, commercial complexes and residences is also poised to fuel furniture sales in the coming years. With rising discretionary income, consumer`s preference for western furniture is also increasing in developing countries. The middle and upper-middle range furniture has also witnessed growth over the years. Asia-Pacific region is projected to be a major growth driver in the global furniture and fixtures market in coming years. The region is likely to become the hub of production as several large manufacturers from developed countries are establishing operations to source furniture manufacturing. Primary factors driving the shift of production bases to Asia-pacific include low cost advantage in terms of production, labor, and skilled workforce. China presents a huge customer base and a booming economy for rapid market growth. Other major countries with significant market potential include Vietnam, Thailand, Korea, and Malaysia. Plastic Segment to Reach $102 Billion by 2026In the global Plastic segment, USA, Canada, Japan, China and Europe will drive the 4.2% CAGR estimated for this segment. These regional markets accounting for a combined market size of US$55.2 Billion in the year 2020 will reach a projected size of US$73.5 Billion by the close of the analysis period. China will remain among the fastest growing in this cluster of regional markets. Led by countries such as Australia, India, and South Korea, the market in Asia-Pacific is forecast to reach US$21.8 Billion by the year 2026, while Latin America will expand at a 5.4% CAGR through the analysis period.Select Competitors (Total 594 Featured) -

Read the full report: https://www.reportlinker.com/p05817853/?utm_source=GNWI. METHODOLOGYII. EXECUTIVE SUMMARY1. MARKET OVERVIEWImpact of COVID-19 Pandemic and Looming Global Recession2020 Marked as a Year of Disruption & TransformationWorld Economic Growth Projections (Real GDP, Annual % Change)for 2020 through 2022As COVID-19 Pandemic Affects the World, Non-Essential FurnitureSales Take a HitTrend towards WFM Model Impacts Sales of Office FurnitureCompanies Make a Shift Towards Remote Working Mandated byCOVID-19 Outbreak, Affecting Sales of Office Furniture: WFMEmployees as a % of the Total Workforce 2019, 2020 and 2021While Store Sales Decline, Online Furniture Sales Report GrowthPost Pandemic Strategies for Furniture ManufacturersFurniture - Global Key Competitors Percentage Market Share in2022 (E)Furniture: Product ProfileFurniture Market by MaterialFurniture Market by End-UseGlobal Market Prospects & OutlookWood Leads the Furniture Market by MaterialHome Furniture Leads, Corporate Needs to Drive Growth in OfficeFurniture MarketOnline Sales Continue to Gain Traction in Furniture MarketDeveloping Economies Poised to Drive Long-term GrowthProduction ScenarioMajor Furniture Manufacturing Countries Worldwide: 2020EGlobal Furniture Market: Breakdown of Export Value (in %) byCountry for 2020Global Furniture Market: Breakdown of Import Value (in %) byCountry for 2020CompetitionWorld BrandsRecent Market ActivityCompetitive Market Presence - Strong/Active/Niche/Trivial forPlayers Worldwide in 2022 (E)2. FOCUS ON SELECT PLAYERS3. MARKET TRENDS & DRIVERSNotable Trends Influencing Growth Outlook in the Furniture MarketTechnology Trends Influencing Growth of Furniture Industry3D Modelling & Visualization Adds New Capabilities in FurnitureDesignTech-Enabled Smart Furniture Comes to the ForeGrowing Popularity of Eco-Friendly FurnitureRising Obesity Levels Drive the Need for Larger FurnitureObesity Prevalence Rate (%) in Select Countries for the Years2019 and 2030PAverage Per Capita Annual Health Expenditure (In US$) due toObesityRestaurants Look to Accommodate Obese CustomersPlus-Sized Furniture for Addressing Needs of Overweight PeopleRise in Demand for Multi-Functional Furniture for Homes andFlexible WorkspacesSelect Types of Multipurpose Furniture for Space Constrained HomesChanging Trends in the Choice of Materials Used in FurnitureIncreasing Trend Towards Smart Homes Drives Demand for SmartFurnitureSmart Home Penetration Rate (%) by Region/Country: 2020Global Smart Home Penetration Rate (%): 2017-2025A Review of Select Smart Furniture ProductsChallenges Facing Smart Furniture ManufacturersPre-assembled or Ready-to-assemble (RTA) Furniture Gets PopularOffice Furniture Market Facing Challenging Times Amidst thePandemicMultifunctional and Personalized Office Furniture to DriveMarket GainsEco-Friendly Office Furniture Find FavorPrivate Sector Drives Growth in Office Furniture MarketInfrastructure Transformation in Emerging Economies: Potentialfor GrowthOffice Furniture Design Trends in the Post-COVID EraVaried Designs for Different Customers? NeedsAdvent of Innovative and Inexpensive FurnitureLow Imports in Developed Countries Affect Market DevelopmentOnline Sales of Office Furniture Gather PaceGlobal Office Furniture Market by Distribution Channel (in %)for 2020Fierce competition in the Office Furniture MarketHome Furniture Market: Stable Growth AheadWooden Furniture Continue to Hold Prominence among CustomersPlastic Furniture: Lightweight and Low Cost Attributes PropelSalesPlastic Furniture Market Worldwide by End-Use (in %) for 2020EPlastic Furniture Market Worldwide by Distribution Channel(in %) for 2020ECustomers Exhibit Inclination towards Recycled Plastic FurnitureNeed for High-End Goods to Foster Demand for Luxury FurnitureLuxury Furniture Market by Material Type (in %) for 2020Luxury Furniture Sales Hit Hard by the PandemicTransforming Luxury Furniture Designs: A ReviewFolding Furniture Sales Benefit from the Growing Needs ofConstrained SpacesOutdoor Furniture Continues Gain MomentumBranded Furniture Finds FavorCompetitive ScenarioHealthcare Industry Creates Strong Demand for Aesthetic andErgonomically Designed Furniture Post-PandemicDTC (Direct To Consumer) Channel Gains Popularity in FurnitureMarketBenefits of DTC model in Furniture Brand BusinessesMarketing DTC FurnitureDigital Sales of Furniture Products Gain Traction Worldwidee-Commerce Platforms Boost Sales of FurnitureGlobal e-Commerce Market Growth Outlook (In %) For Years 2019Through 2025B2B E-Commerce Driving Growth in Furniture Industry DuringCOVID-19 PandemicNoteworthy E-commerce Trends in Furniture & FurnishingsMarketplaceManufacturers and Retailers Focus on Enhancing PersonalizedExperiences for CustomersProduct Customization: A Win-Win ApproachErgonomic Furniture Gains Spotlight in Offices and EducationalInstitutionsAugmented Reality Emerges as a Viable Marketing ToolMillennials Emerge as an Important Demographic for FurnitureRetailers and BrandsGlobal Millennials Population Spread by Region: 2019Millennial Population as a Percentage (%) of Total Populationin Select Countries: 2019Marketing Strategies for MillennialsDecline in Hospitality Industry Hits Furniture SalesGlobal Hotels and Hospitality Market Reset & Trajectory -Growth Outlook (In %) For Years 2019 Through 2025COVID-19 Impact on Travel & Tourism Industry: Growth Rate (%)of Industry Revenues in Select Countries for 2020 Vs 2019Residential and Commercial Construction Trends InfluenceFurniture SalesGlobal Construction Reset & Trajectory: Growth Outlook (In %)For Years 2019 Through 2025Macro Drivers and Demographic Trends Influence Market ProspectsExpanding Global PopulationWorld Population (in Thousands) by Geographic Region for theYears 2019, 2030, 2050, 2100Urbanization TrendWorld Urban Population in Thousands: 1950-2050PDegree of Urbanization Worldwide: Urban Population as a % ofTotal Population by Geographic Region for the Years 1950,1970, 1990, 2018, 2030 and 2050Burgeoning Middle Class PopulationGlobal Middle Class Population (In Million) by Region for theYears 2020, 2025 and 2030Global Middle Class Spending (US$ Trillion) by Region for theYears 2020, 2025, 20304. GLOBAL MARKET PERSPECTIVETable 1: World Recent Past, Current & Future Analysis forFurniture by Geographic Region - USA, Canada, Japan, China,Europe, Asia-Pacific, Latin America, Middle East and AfricaMarkets - Independent Analysis of Annual Sales in US$ Millionfor Years 2020 through 2027 and % CAGRTable 2: World Historic Review for Furniture by GeographicRegion - USA, Canada, Japan, China, Europe, Asia-Pacific, LatinAmerica, Middle East and Africa Markets - Independent Analysisof Annual Sales in US$ Million for Years 2012 through 2019 and% CAGRTable 3: World 15-Year Perspective for Furniture by GeographicRegion - Percentage Breakdown of Value Sales for USA, Canada,Japan, China, Europe, Asia-Pacific, Latin America, Middle Eastand Africa Markets for Years 2012, 2021 & 2027Table 4: World Recent Past, Current & Future Analysis for Woodby Geographic Region - USA, Canada, Japan, China, Europe,Asia-Pacific, Latin America, Middle East and Africa Markets -Independent Analysis of Annual Sales in US$ Million for Years2020 through 2027 and % CAGRTable 5: World Historic Review for Wood by Geographic Region -USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America,Middle East and Africa Markets - Independent Analysis of AnnualSales in US$ Million for Years 2012 through 2019 and % CAGRTable 6: World 15-Year Perspective for Wood by GeographicRegion - Percentage Breakdown of Value Sales for USA, Canada,Japan, China, Europe, Asia-Pacific, Latin America, Middle Eastand Africa for Years 2012, 2021 & 2027Table 7: World Recent Past, Current & Future Analysis for Metalby Geographic Region - USA, Canada, Japan, China, Europe,Asia-Pacific, Latin America, Middle East and Africa Markets -Independent Analysis of Annual Sales in US$ Million for Years2020 through 2027 and % CAGRTable 8: World Historic Review for Metal by Geographic Region -USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America,Middle East and Africa Markets - Independent Analysis of AnnualSales in US$ Million for Years 2012 through 2019 and % CAGRTable 9: World 15-Year Perspective for Metal by GeographicRegion - Percentage Breakdown of Value Sales for USA, Canada,Japan, China, Europe, Asia-Pacific, Latin America, Middle Eastand Africa for Years 2012, 2021 & 2027Table 10: World Recent Past, Current & Future Analysis forPlastic by Geographic Region - USA, Canada, Japan, China,Europe, Asia-Pacific, Latin America, Middle East and AfricaMarkets - Independent Analysis of Annual Sales in US$ Millionfor Years 2020 through 2027 and % CAGRTable 11: World Historic Review for Plastic by GeographicRegion - USA, Canada, Japan, China, Europe, Asia-Pacific, LatinAmerica, Middle East and Africa Markets - Independent Analysisof Annual Sales in US$ Million for Years 2012 through 2019 and% CAGRTable 12: World 15-Year Perspective for Plastic by GeographicRegion - Percentage Breakdown of Value Sales for USA, Canada,Japan, China, Europe, Asia-Pacific, Latin America, Middle Eastand Africa for Years 2012, 2021 & 2027Table 13: World Recent Past, Current & Future Analysis forGlass by Geographic Region - USA, Canada, Japan, China, Europe,Asia-Pacific, Latin America, Middle East and Africa Markets -Independent Analysis of Annual Sales in US$ Million for Years2020 through 2027 and % CAGRTable 14: World Historic Review for Glass by Geographic Region -USA, Canada, Japan, China, Europe, Asia-Pacific, LatinAmerica, Middle East and Africa Markets - Independent Analysisof Annual Sales in US$ Million for Years 2012 through 2019 and% CAGRTable 15: World 15-Year Perspective for Glass by GeographicRegion - Percentage Breakdown of Value Sales for USA, Canada,Japan, China, Europe, Asia-Pacific, Latin America, Middle Eastand Africa for Years 2012, 2021 & 2027Table 16: World Recent Past, Current & Future Analysis forOther Materials by Geographic Region - USA, Canada, Japan,China, Europe, Asia-Pacific, Latin America, Middle East andAfrica Markets - Independent Analysis of Annual Sales in US$Million for Years 2020 through 2027 and % CAGRTable 17: World Historic Review for Other Materials byGeographic Region - USA, Canada, Japan, China, Europe,Asia-Pacific, Latin America, Middle East and Africa Markets -Independent Analysis of Annual Sales in US$ Million for Years2012 through 2019 and % CAGRTable 18: World 15-Year Perspective for Other Materials byGeographic Region - Percentage Breakdown of Value Sales forUSA, Canada, Japan, China, Europe, Asia-Pacific, Latin America,Middle East and Africa for Years 2012, 2021 & 2027Table 19: World Recent Past, Current & Future Analysis forResidential by Geographic Region - USA, Canada, Japan, China,Europe, Asia-Pacific, Latin America, Middle East and AfricaMarkets - Independent Analysis of Annual Sales in US$ Millionfor Years 2020 through 2027 and % CAGRTable 20: World Historic Review for Residential by GeographicRegion - USA, Canada, Japan, China, Europe, Asia-Pacific, LatinAmerica, Middle East and Africa Markets - Independent Analysisof Annual Sales in US$ Million for Years 2012 through 2019 and% CAGRTable 21: World 15-Year Perspective for Residential byGeographic Region - Percentage Breakdown of Value Sales forUSA, Canada, Japan, China, Europe, Asia-Pacific, Latin America,Middle East and Africa for Years 2012, 2021 & 2027Table 22: World Recent Past, Current & Future Analysis forCommercial by Geographic Region - USA, Canada, Japan, China,Europe, Asia-Pacific, Latin America, Middle East and AfricaMarkets - Independent Analysis of Annual Sales in US$ Millionfor Years 2020 through 2027 and % CAGRTable 23: World Historic Review for Commercial by GeographicRegion - USA, Canada, Japan, China, Europe, Asia-Pacific, LatinAmerica, Middle East and Africa Markets - Independent Analysisof Annual Sales in US$ Million for Years 2012 through 2019 and% CAGRTable 24: World 15-Year Perspective for Commercial byGeographic Region - Percentage Breakdown of Value Sales forUSA, Canada, Japan, China, Europe, Asia-Pacific, Latin America,Middle East and Africa for Years 2012, 2021 & 2027III. MARKET ANALYSISUNITED STATESFurniture Market Presence - Strong/Active/Niche/Trivial - KeyCompetitors in the United States for 2022 (E)The United states: Major Market for FurnitureCOVID-19 Crisis Derails Momentum in the US Furniture MarketVendors Take Proactive Measure to Contain Business LossesHome Furniture Market in the USOffice Furniture Market Remains Subdued Amidst the PandemicUS Office Furniture Market by Product (in %) for 2020Real Estate Sector and Residential & Commercial ConstructionsInfluence Furniture SalesNumber of Housing Starts in Thousand Units by Type for Single-Family Units and Multi-Family Units (Apr 2020-Apr 2021)US Construction Value (in US$ Million) for Residential and Non-Residential Sectors for Apr-2020 to Apr-2021Online Retailers Make Big Gains During the Pandemic PeriodLeading Online Furniture Retailers (in %) in the US: 2020Table 25: USA Recent Past, Current & Future Analysis forFurniture by Material - Wood, Metal, Plastic, Glass and OtherMaterials - Independent Analysis of Annual Sales in US$ Millionfor the Years 2020 through 2027 and % CAGRTable 26: USA Historic Review for Furniture by Material - Wood,Metal, Plastic, Glass and Other Materials Markets - IndependentAnalysis of Annual Sales in US$ Million for Years 2012 through2019 and % CAGRTable 27: USA 15-Year Perspective for Furniture by Material -Percentage Breakdown of Value Sales for Wood, Metal, Plastic,Glass and Other Materials for the Years 2012, 2021 & 2027Table 28: USA Recent Past, Current & Future Analysis forFurniture by End-Use - Residential and Commercial - IndependentAnalysis of Annual Sales in US$ Million for the Years 2020through 2027 and % CAGRTable 29: USA Historic Review for Furniture by End-Use -Residential and Commercial Markets - Independent Analysis ofAnnual Sales in US$ Million for Years 2012 through 2019 and %CAGRTable 30: USA 15-Year Perspective for Furniture by End-Use -Percentage Breakdown of Value Sales for Residential andCommercial for the Years 2012, 2021 & 2027CANADATable 31: Canada Recent Past, Current & Future Analysis forFurniture by Material - Wood, Metal, Plastic, Glass and OtherMaterials - Independent Analysis of Annual Sales in US$ Millionfor the Years 2020 through 2027 and % CAGRTable 32: Canada Historic Review for Furniture by Material -Wood, Metal, Plastic, Glass and Other Materials Markets -Independent Analysis of Annual Sales in US$ Million for Years2012 through 2019 and % CAGRTable 33: Canada 15-Year Perspective for Furniture by Material -Percentage Breakdown of Value Sales for Wood, Metal, Plastic,Glass and Other Materials for the Years 2012, 2021 & 2027Table 34: Canada Recent Past, Current & Future Analysis forFurniture by End-Use - Residential and Commercial - IndependentAnalysis of Annual Sales in US$ Million for the Years 2020through 2027 and % CAGRTable 35: Canada Historic Review for Furniture by End-Use -Residential and Commercial Markets - Independent Analysis ofAnnual Sales in US$ Million for Years 2012 through 2019 and %CAGRTable 36: Canada 15-Year Perspective for Furniture by End-Use -Percentage Breakdown of Value Sales for Residential andCommercial for the Years 2012, 2021 & 2027JAPANFurniture Market Presence - Strong/Active/Niche/Trivial - KeyCompetitors in Japan for 2022 (E)Table 37: Japan Recent Past, Current & Future Analysis forFurniture by Material - Wood, Metal, Plastic, Glass and OtherMaterials - Independent Analysis of Annual Sales in US$ Millionfor the Years 2020 through 2027 and % CAGRTable 38: Japan Historic Review for Furniture by Material -Wood, Metal, Plastic, Glass and Other Materials Markets -Independent Analysis of Annual Sales in US$ Million for Years2012 through 2019 and % CAGRTable 39: Japan 15-Year Perspective for Furniture by Material -Percentage Breakdown of Value Sales for Wood, Metal, Plastic,Glass and Other Materials for the Years 2012, 2021 & 2027Table 40: Japan Recent Past, Current & Future Analysis forFurniture by End-Use - Residential and Commercial - IndependentAnalysis of Annual Sales in US$ Million for the Years 2020through 2027 and % CAGRTable 41: Japan Historic Review for Furniture by End-Use -Residential and Commercial Markets - Independent Analysis ofAnnual Sales in US$ Million for Years 2012 through 2019 and %CAGRTable 42: Japan 15-Year Perspective for Furniture by End-Use -Percentage Breakdown of Value Sales for Residential andCommercial for the Years 2012, 2021 & 2027CHINAFurniture Market Presence - Strong/Active/Niche/Trivial - KeyCompetitors in China for 2022 (E)Market OverviewTable 43: China Recent Past, Current & Future Analysis forFurniture by Material - Wood, Metal, Plastic, Glass and OtherMaterials - Independent Analysis of Annual Sales in US$ Millionfor the Years 2020 through 2027 and % CAGRTable 44: China Historic Review for Furniture by Material -Wood, Metal, Plastic, Glass and Other Materials Markets -Independent Analysis of Annual Sales in US$ Million for Years2012 through 2019 and % CAGRTable 45: China 15-Year Perspective for Furniture by Material -Percentage Breakdown of Value Sales for Wood, Metal, Plastic,Glass and Other Materials for the Years 2012, 2021 & 2027Table 46: China Recent Past, Current & Future Analysis forFurniture by End-Use - Residential and Commercial - IndependentAnalysis of Annual Sales in US$ Million for the Years 2020through 2027 and % CAGRTable 47: China Historic Review for Furniture by End-Use -Residential and Commercial Markets - Independent Analysis ofAnnual Sales in US$ Million for Years 2012 through 2019 and %CAGRTable 48: China 15-Year Perspective for Furniture by End-Use -Percentage Breakdown of Value Sales for Residential andCommercial for the Years 2012, 2021 & 2027EUROPEFurniture Market Presence - Strong/Active/Niche/Trivial - KeyCompetitors in Europe for 2022 (E)Market OverviewTable 49: Europe Recent Past, Current & Future Analysis forFurniture by Geographic Region - France, Germany, Italy, UK,Spain, Russia and Rest of Europe Markets - Independent Analysisof Annual Sales in US$ Million for Years 2020 through 2027 and% CAGRTable 50: Europe Historic Review for Furniture by GeographicRegion - France, Germany, Italy, UK, Spain, Russia and Rest ofEurope Markets - Independent Analysis of Annual Sales in US$Million for Years 2012 through 2019 and % CAGRTable 51: Europe 15-Year Perspective for Furniture byGeographic Region - Percentage Breakdown of Value Sales forFrance, Germany, Italy, UK, Spain, Russia and Rest of EuropeMarkets for Years 2012, 2021 & 2027Table 52: Europe Recent Past, Current & Future Analysis forFurniture by Material - Wood, Metal, Plastic, Glass and OtherMaterials - Independent Analysis of Annual Sales in US$ Millionfor the Years 2020 through 2027 and % CAGRTable 53: Europe Historic Review for Furniture by Material -Wood, Metal, Plastic, Glass and Other Materials Markets -Independent Analysis of Annual Sales in US$ Million for Years2012 through 2019 and % CAGRTable 54: Europe 15-Year Perspective for Furniture by Material -Percentage Breakdown of Value Sales for Wood, Metal, Plastic,Glass and Other Materials for the Years 2012, 2021 & 2027Table 55: Europe Recent Past, Current & Future Analysis forFurniture by End-Use - Residential and Commercial - IndependentAnalysis of Annual Sales in US$ Million for the Years 2020through 2027 and % CAGRTable 56: Europe Historic Review for Furniture by End-Use -Residential and Commercial Markets - Independent Analysis ofAnnual Sales in US$ Million for Years 2012 through 2019 and %CAGRTable 57: Europe 15-Year Perspective for Furniture by End-Use -Percentage Breakdown of Value Sales for Residential andCommercial for the Years 2012, 2021 & 2027FRANCEFurniture Market Presence - Strong/Active/Niche/Trivial - KeyCompetitors in France for 2022 (E)Table 58: France Recent Past, Current & Future Analysis forFurniture by Material - Wood, Metal, Plastic, Glass and OtherMaterials - Independent Analysis of Annual Sales in US$ Millionfor the Years 2020 through 2027 and % CAGRTable 59: France Historic Review for Furniture by Material -Wood, Metal, Plastic, Glass and Other Materials Markets -Independent Analysis of Annual Sales in US$ Million for Years2012 through 2019 and % CAGRTable 60: France 15-Year Perspective for Furniture by Material -Percentage Breakdown of Value Sales for Wood, Metal, Plastic,Glass and Other Materials for the Years 2012, 2021 & 2027Table 61: France Recent Past, Current & Future Analysis forFurniture by End-Use - Residential and Commercial - IndependentAnalysis of Annual Sales in US$ Million for the Years 2020through 2027 and % CAGRTable 62: France Historic Review for Furniture by End-Use -Residential and Commercial Markets - Independent Analysis ofAnnual Sales in US$ Million for Years 2012 through 2019 and %CAGRTable 63: France 15-Year Perspective for Furniture by End-Use -Percentage Breakdown of Value Sales for Residential andCommercial for the Years 2012, 2021 & 2027GERMANYFurniture Market Presence - Strong/Active/Niche/Trivial - KeyCompetitors in Germany for 2022 (E)Table 64: Germany Recent Past, Current & Future Analysis forFurniture by Material - Wood, Metal, Plastic, Glass and OtherMaterials - Independent Analysis of Annual Sales in US$ Millionfor the Years 2020 through 2027 and % CAGRTable 65: Germany Historic Review for Furniture by Material -Wood, Metal, Plastic, Glass and Other Materials Markets -Independent Analysis of Annual Sales in US$ Million for Years2012 through 2019 and % CAGRTable 66: Germany 15-Year Perspective for Furniture by Material -Percentage Breakdown of Value Sales for Wood, Metal, Plastic,Glass and Other Materials for the Years 2012, 2021 & 2027Table 67: Germany Recent Past, Current & Future Analysis forFurniture by End-Use - Residential and Commercial - IndependentAnalysis of Annual Sales in US$ Million for the Years 2020through 2027 and % CAGRTable 68: Germany Historic Review for Furniture by End-Use -Residential and Commercial Markets - Independent Analysis ofAnnual Sales in US$ Million for Years 2012 through 2019 and %CAGRTable 69: Germany 15-Year Perspective for Furniture by End-Use -Percentage Breakdown of Value Sales for Residential andCommercial for the Years 2012, 2021 & 2027ITALYTable 70: Italy Recent Past, Current & Future Analysis forFurniture by Material - Wood, Metal, Plastic, Glass and OtherMaterials - Independent Analysis of Annual Sales in US$ Millionfor the Years 2020 through 2027 and % CAGRTable 71: Italy Historic Review for Furniture by Material -Wood, Metal, Plastic, Glass and Other Materials Markets -Independent Analysis of Annual Sales in US$ Million for Years2012 through 2019 and % CAGRTable 72: Italy 15-Year Perspective for Furniture by Material -Percentage Breakdown of Value Sales for Wood, Metal, Plastic,Glass and Other Materials for the Years 2012, 2021 & 2027Table 73: Italy Recent Past, Current & Future Analysis forFurniture by End-Use - Residential and Commercial - IndependentAnalysis of Annual Sales in US$ Million for the Years 2020through 2027 and % CAGRTable 74: Italy Historic Review for Furniture by End-Use -Residential and Commercial Markets - Independent Analysis ofAnnual Sales in US$ Million for Years 2012 through 2019 and %CAGRTable 75: Italy 15-Year Perspective for Furniture by End-Use -Percentage Breakdown of Value Sales for Residential andCommercial for the Years 2012, 2021 & 2027UNITED KINGDOMFurniture Market Presence - Strong/Active/Niche/Trivial - KeyCompetitors in the United Kingdom for 2022 (E)UK Home Furniture Market: An OverviewTable 76: UK Recent Past, Current & Future Analysis forFurniture by Material - Wood, Metal, Plastic, Glass and OtherMaterials - Independent Analysis of Annual Sales in US$ Millionfor the Years 2020 through 2027 and % CAGRTable 77: UK Historic Review for Furniture by Material - Wood,Metal, Plastic, Glass and Other Materials Markets - IndependentAnalysis of Annual Sales in US$ Million for Years 2012 through2019 and % CAGRTable 78: UK 15-Year Perspective for Furniture by Material -Percentage Breakdown of Value Sales for Wood, Metal, Plastic,Glass and Other Materials for the Years 2012, 2021 & 2027Table 79: UK Recent Past, Current & Future Analysis forFurniture by End-Use - Residential and Commercial - IndependentAnalysis of Annual Sales in US$ Million for the Years 2020through 2027 and % CAGRTable 80: UK Historic Review for Furniture by End-Use -Residential and Commercial Markets - Independent Analysis ofAnnual Sales in US$ Million for Years 2012 through 2019 and %CAGRTable 81: UK 15-Year Perspective for Furniture by End-Use -Percentage Breakdown of Value Sales for Residential andCommercial for the Years 2012, 2021 & 2027SPAINTable 82: Spain Recent Past, Current & Future Analysis forFurniture by Material - Wood, Metal, Plastic, Glass and OtherMaterials - Independent Analysis of Annual Sales in US$ Millionfor the Years 2020 through 2027 and % CAGRTable 83: Spain Historic Review for Furniture by Material -Wood, Metal, Plastic, Glass and Other Materials Markets -Independent Analysis of Annual Sales in US$ Million for Years2012 through 2019 and % CAGRTable 84: Spain 15-Year Perspective for Furniture by Material -Percentage Breakdown of Value Sales for Wood, Metal, Plastic,Glass and Other Materials for the Years 2012, 2021 & 2027Table 85: Spain Recent Past, Current & Future Analysis forFurniture by End-Use - Residential and Commercial - IndependentAnalysis of Annual Sales in US$ Million for the Years 2020through 2027 and % CAGRTable 86: Spain Historic Review for Furniture by End-Use -Residential and Commercial Markets - Independent Analysis ofAnnual Sales in US$ Million for Years 2012 through 2019 and %CAGRTable 87: Spain 15-Year Perspective for Furniture by End-Use -Percentage Breakdown of Value Sales for Residential andCommercial for the Years 2012, 2021 & 2027RUSSIATable 88: Russia Recent Past, Current & Future Analysis forFurniture by Material - Wood, Metal, Plastic, Glass and OtherMaterials - Independent Analysis of Annual Sales in US$ Millionfor the Years 2020 through 2027 and % CAGRTable 89: Russia Historic Review for Furniture by Material -Wood, Metal, Plastic, Glass and Other Materials Markets -Independent Analysis of Annual Sales in US$ Million for Years2012 through 2019 and % CAGRTable 90: Russia 15-Year Perspective for Furniture by Material -Percentage Breakdown of Value Sales for Wood, Metal, Plastic,Glass and Other Materials for the Years 2012, 2021 & 2027Table 91: Russia Recent Past, Current & Future Analysis forFurniture by End-Use - Residential and Commercial - IndependentAnalysis of Annual Sales in US$ Million for the Years 2020through 2027 and % CAGRTable 92: Russia Historic Review for Furniture by End-Use -Residential and Commercial Markets - Independent Analysis ofAnnual Sales in US$ Million for Years 2012 through 2019 and %CAGRTable 93: Russia 15-Year Perspective for Furniture by End-Use -Percentage Breakdown of Value Sales for Residential andCommercial for the Years 2012, 2021 & 2027REST OF EUROPETable 94: Rest of Europe Recent Past, Current & Future Analysisfor Furniture by Material - Wood, Metal, Plastic, Glass andOther Materials - Independent Analysis of Annual Sales in US$Million for the Years 2020 through 2027 and % CAGRTable 95: Rest of Europe Historic Review for Furniture byMaterial - Wood, Metal, Plastic, Glass and Other MaterialsMarkets - Independent Analysis of Annual Sales in US$ Millionfor Years 2012 through 2019 and % CAGRTable 96: Rest of Europe 15-Year Perspective for Furniture byMaterial - Percentage Breakdown of Value Sales for Wood, Metal,Plastic, Glass and Other Materials for the Years 2012, 2021 &2027Table 97: Rest of Europe Recent Past, Current & Future Analysisfor Furniture by End-Use - Residential and Commercial -Independent Analysis of Annual Sales in US$ Million for theYears 2020 through 2027 and % CAGRTable 98: Rest of Europe Historic Review for Furniture byEnd-Use - Residential and Commercial Markets - IndependentAnalysis of Annual Sales in US$ Million for Years 2012 through2019 and % CAGRTable 99: Rest of Europe 15-Year Perspective for Furniture byEnd-Use - Percentage Breakdown of Value Sales for Residentialand Commercial for the Years 2012, 2021 & 2027ASIA-PACIFICFurniture Market Presence - Strong/Active/Niche/Trivial - KeyCompetitors in Asia-Pacific for 2022 (E)Table 100: Asia-Pacific Recent Past, Current & Future Analysisfor Furniture by Geographic Region - Australia, India, SouthKorea and Rest of Asia-Pacific Markets - Independent Analysisof Annual Sales in US$ Million for Years 2020 through 2027 and% CAGRTable 101: Asia-Pacific Historic Review for Furniture byGeographic Region - Australia, India, South Korea and Rest ofAsia-Pacific Markets - Independent Analysis of Annual Sales inUS$ Million for Years 2012 through 2019 and % CAGRTable 102: Asia-Pacific 15-Year Perspective for Furniture byGeographic Region - Percentage Breakdown of Value Sales forAustralia, India, South Korea and Rest of Asia-Pacific Marketsfor Years 2012, 2021 & 2027Table 103: Asia-Pacific Recent Past, Current & Future Analysisfor Furniture by Material - Wood, Metal, Plastic, Glass andOther Materials - Independent Analysis of Annual Sales in US$Million for the Years 2020 through 2027 and % CAGRTable 104: Asia-Pacific Historic Review for Furniture byMaterial - Wood, Metal, Plastic, Glass and Other MaterialsMarkets - Independent Analysis of Annual Sales in US$ Millionfor Years 2012 through 2019 and % CAGRTable 105: Asia-Pacific 15-Year Perspective for Furniture byMaterial - Percentage Breakdown of Value Sales for Wood, Metal,Plastic, Glass and Other Materials for the Years 2012, 2021 &2027Table 106: Asia-Pacific Recent Past, Current & Future Analysisfor Furniture by End-Use - Residential and Commercial -Independent Analysis of Annual Sales in US$ Million for theYears 2020 through 2027 and % CAGRTable 107: Asia-Pacific Historic Review for Furniture byEnd-Use - Residential and Commercial Markets - IndependentAnalysis of Annual Sales in US$ Million for Years 2012 through2019 and % CAGRTable 108: Asia-Pacific 15-Year Perspective for Furniture byEnd-Use - Percentage Breakdown of Value Sales for Residentialand Commercial for the Years 2012, 2021 & 2027AUSTRALIAFurniture Market Presence - Strong/Active/Niche/Trivial - KeyCompetitors in Australia for 2022 (E)Market OverviewTable 109: Australia Recent Past, Current & Future Analysis forFurniture by Material - Wood, Metal, Plastic, Glass and OtherMaterials - Independent Analysis of Annual Sales in US$ Millionfor the Years 2020 through 2027 and % CAGRTable 110: Australia Historic Review for Furniture by Material -Wood, Metal, Plastic, Glass and Other Materials Markets -Independent Analysis of Annual Sales in US$ Million for YearsPlease contact our Customer Support Center to get the complete Table of ContentsRead the full report: https://www.reportlinker.com/p05817853/?utm_source=GNWAbout ReportlinkerReportLinker is an award-winning market research solution. Reportlinker finds and organizes the latest industry data so you get all the market research you need - instantly, in one place.__________________________